In explaining the impact of climate change on hurricanes, risk modeller Karen Clark & Company explains that intensity of tropical cyclones has risen with a warming climate, leading it to believe hurricane losses may already be elevated by 11% due to climate change, with as much as another 19% increase possible by 2050 if warming continues.

Some companies are less inclined to explicitly link climate change to increasing insured damages from natural catastrophe events such as hurricanes.

Some companies are less inclined to explicitly link climate change to increasing insured damages from natural catastrophe events such as hurricanes.

But Karen Clark & Company is prepared to put its research behind its claims, saying that its analysis shows that a “shift in hurricane intensity has likely already led to an increase in insured losses of about 11 percent above what the loss potential would have been in the absence of climate change.”

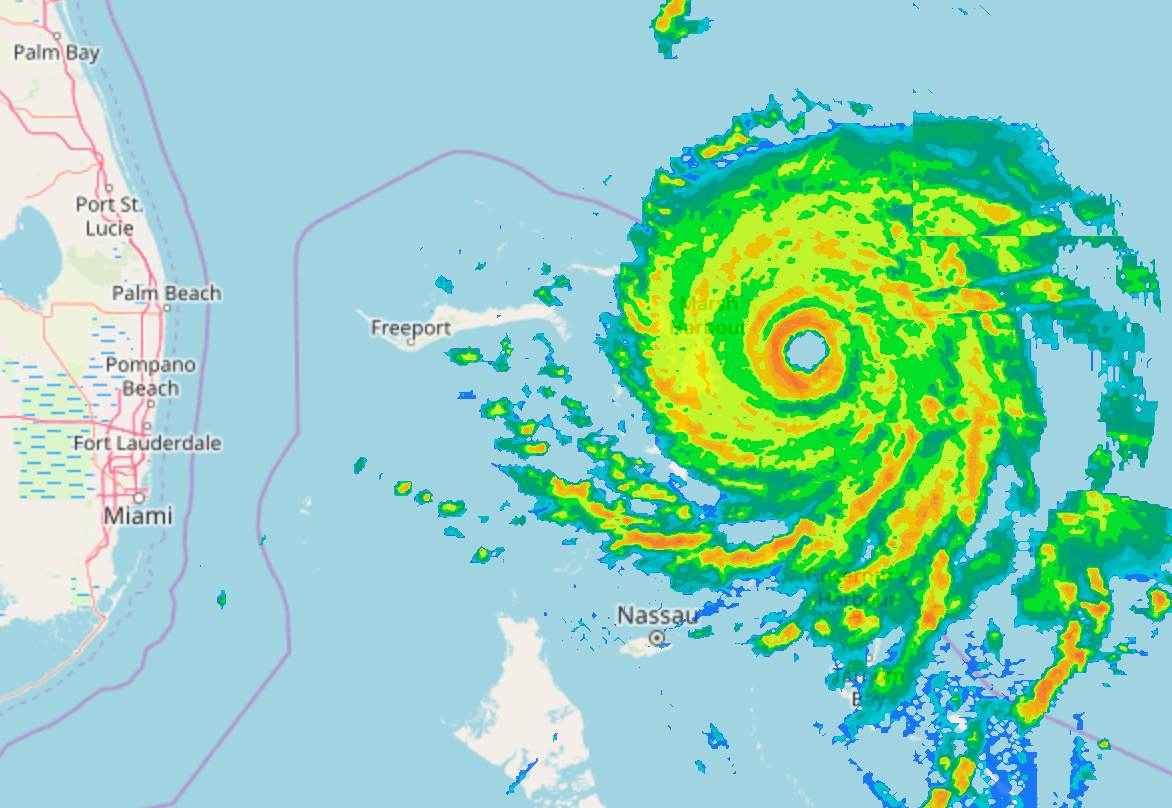

“Tropical cyclone intensity has increased with the warming climate, leading to a shift toward a higher proportion of major hurricanes—Category 3-5 on the Saffir-Simpson scale,” KCC said.

With global temperatures already seen as 1.1°C higher, relative to the 1850 to 1900 average, KCC notes that now global temperatures are projected to increase by an additional 0.4 to 1.3°C by 2050, depending on the emissions scenario used.

Which it suggests could mean, “Average annual hurricane wind losses will increase an additional 10 to 19 percent by 2050 depending on the emissions scenario, but the increases will be larger for the lower return period losses on the Exceedance Probability (EP) curves and slightly less for the high return period losses.”

In analysing hurricane wind loss potential, under different climate scenarios, KCC says that “The lower return period losses are rising faster—on a percentage basis— than the longer return periods. The 1 in 5-year return period losses, for example, are projected to increase by almost 25 percent in the worst-case SSP5-8.5 scenario, while the 1 in 250-year return period losses increase by 11 percent.”

This could change the shape of the industry’s accepted exceedance probability curve for hurricane risk, while, “An increasing frequency of major hurricanes all along the Gulf, Florida, and Southeast coastlines, and a lower proportion of weaker storms will increase the losses for many landfalling events all along the coast putting more upward pressure on the lower return period losses.”

So while average annual losses from US hurricane wind damage could increase by 10% to 19% by 2050, on top of the 11% that KCC already says is observed, the risk modeller also warns that the percentage increase could be even greater at the lower return periods.

Such an increase would have clear ramifications for the insurance, reinsurance and insurance-linked securities (ILS) industry, as well as for coastal living and the cost of coverage in those regions.

You can read KCC’s report on climate change and how it could impact hurricane wind losses across the insurance and reinsurance industry here.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.