Catastrophe risk modeller Karen Clark & Company (KCC) has estimated that the total insured cost of Hurricane Dorian in both the Caribbean and the US will be $5.2 billion.

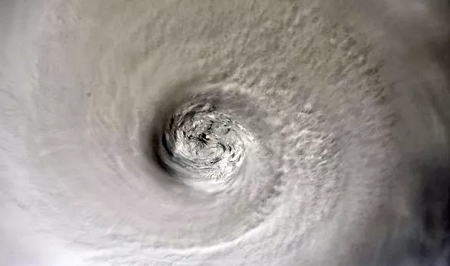

Source: NASA

The estimate reflects a $3.6 billion loss in the Caribbean and a $1.5 billion loss in the US, as well as losses of $23 million in Puerto Rico and $84 million in the US Virgin Islands.

KCC’s figure for the Caribbean comes in at the lower end of the range proposed by RMS earlier today, who estimated that Dorian would drive industry losses of between $3.5 billion and $6.5 billion in the Caribbean.

In contrast, it is slightly above the loss range estimated by AIR Worldwide, who said last week that insured losses in the Caribbean would be between $1.5 billion and $3 billion.

Almost all of the loss in the Caribbean is expected to come from the Bahamas, parts of which were devastated by the storm after it stalled as a Category 5 hurricane over Grand Bahama and the Abaco Islands on September 1.

The risk modeller explained that its new estimate for the Caribbean includes insured losses to commercial, residential and industrial property, and does not include automobiles.

Dorian was the strongest hurricane on record to make landfall in the Bahamas, bringing destructive wind speeds of up to 185 mph and storm surge of up to 20 feet.

The International Red Cross believes that 45% of the homes on Grand Bahama and the Abacos Islands have been severely damaged or destroyed, representing some 13,000 properties.

Damage in the US was much more limited than had originally been feared, when forecasts put the hurricane on a path to make landfall in Florida before turning north and tracking up through the state.

Instead, Dorian turned early and skirted up along the length of the US east coast before briefly making landfall in North Carolina and then moving offshore into the Atlantic.

KCC expects to see widespread low-level wind damage from tropical storm force winds in Florida, Georgia, South Carolina, North Carolina and Virginia.

Hurricane force winds were only experience in coastal areas of North and South Carolina, while predicted storm surge of up to seven feet for Charleston did not manifest and flooding was not as bad as initially feared.

The most severe storm surge, with heights as high as seven feet, was on the Outer Banks of North Carolina near where Dorian made landfall, with some flooding on the first floors of residential and commercial buildings reported.

KCC said its industry loss estimate for the US includes the privately insured wind and storm surge damage to residential, commercial, and industrial properties and automobiles, but does not include NFIP losses.