The Magnitude 7.1 earthquake that impacted the towns of Ridgecrest, Argus, and Trona in the U.S. state of California in early July, is expected to result in overall damages of around $200 million, with the insured loss likely to be less than $40 million, according to Karen Clark & Company (KCC).

On July 5th, a sparsely populated area of southeastern California, roughly 140 miles southwest of Las Vegas, was hit by a M7.1 earthquake, which was preceded by a M6.4 foreshock on July 4th, with an additional 250 foreshocks occurring between the large foreshock and the main M7.1 quake.

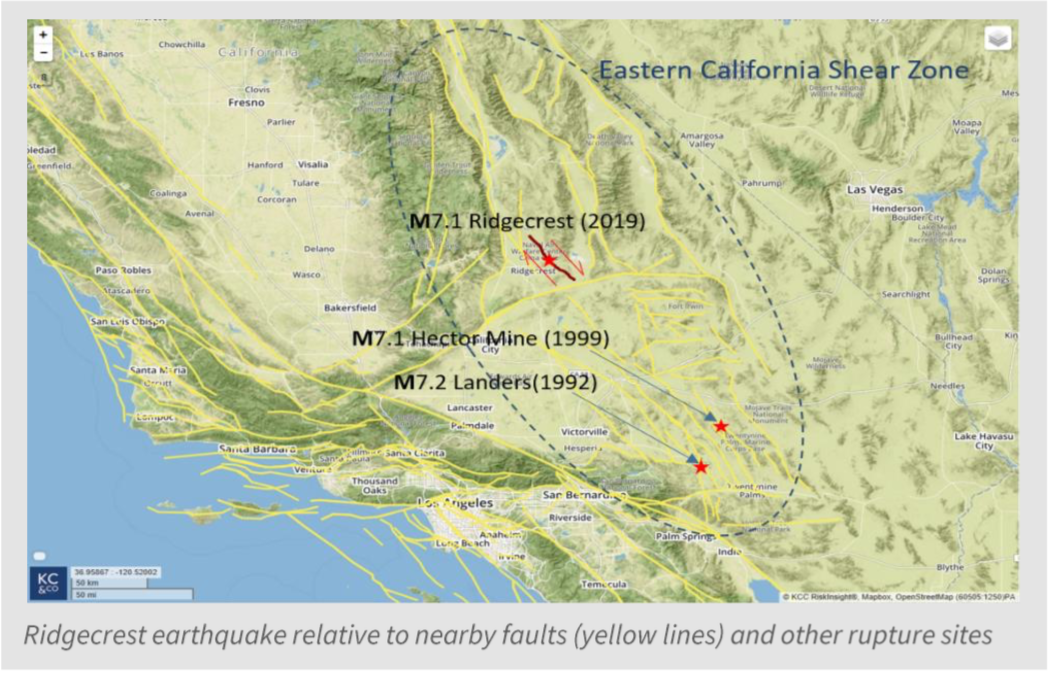

According to KCC, the main earthquake occurred 8km below ground and the rupture length was about 30 miles. The below chart, provided by KCC, shows that the recent quake ruptured in the Eastern California Shear Zone, which the cat risk modeller says has been one of the most seismically active areas in the state in recent times.

The Towns of Ridgecrest, Argus, and Trona were the most impacted, with liquefaction and lateral spreading impacts observed across southern Trona. KCC notes that old masonry structures and mobile homes experienced the most damage, while newer wood frame homes performed relatively well.

With the exception of liquefaction, KCC notes that damage to commercial structures was limited to ceiling, facade, and contents damage, while several roofs also collapsed.

Excluding damages to infrastructure and damage to properties in the Naval Air Weapons Station China Lake, which was over the fault rupture, KCC estimates that the total loss from this event will be roughly $200 million.

“Insured losses will likely be less than $40 million because less than 20% of property owners in the area have earthquake insurance and earthquake deductibles are high,” explains KCC.

Even at $40 million, insurance and/or reinsurance is only expected to cover a fifth of the overall loss, which, is unsurprising given the notable lack of earthquake insurance penetration in California, despite the region’s high susceptibility to quakes.

Currently, analysis puts the percentage of California homes covered by earthquake protection at around 12%, which ultimately means that any significant quake event in a more densely populated area could create billions in uninsured losses.

While the July 5th quake struck a sparsely populated area, it’s a warning and reminder to homeowners and commercial businesses operating in the region that insurance to protect themselves against disaster would be beneficial.